Virtual CFO & Strategic Advisory

Graph Nation: Powering Smart Finance with Real-Time Intelligence

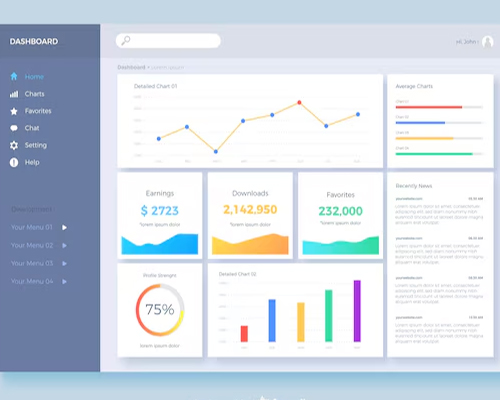

At Graph Nation, we believe that financial decisions should be driven by clarity, speed, and foresight. That’s why we empower businesses with real-time financial dashboards, cash flow insights, predictive risk tools, and automated compliance checks—all seamlessly integrated into one powerful analytics ecosystem. Whether you’re a CFO steering strategy or a finance team managing daily operations, Graphnation gives you the tools to stay ahead in an ever-evolving financial landscape.

With data-driven decision-making at the core of everything we do, Graphnation turns complex financial data into intuitive, actionable visuals. Our platform helps you go beyond static reports, enabling smarter forecasting, risk reduction, and regulatory compliance—without the noise or guesswork. We don’t just visualize your data—we make it work for you.

Real-Time Financial Dashboards

At Graph Nation, our real-time financial dashboards bring your numbers to life. Designed for clarity, speed, and impact, these dashboards provide a live, unified view of your company’s financial health by seamlessly integrating data from accounting software, ERP systems, and bank feeds. Whether you’re tracking profitability, monitoring KPIs, or preparing for a board meeting, our customizable interface ensures you always see what matters most—when it matters most.

But it doesn’t stop there. Our dashboards go beyond passive reporting with built-in trend analysis, predictive risk management, and real-time compliance checks. Get instant alerts for cash flow anomalies, potential fraud, or regulatory issues—before they become problems.

Cash Flow Monitoring & Trend Analysis

Stay in control of your liquidity with Graph Nation advanced cash flow monitoring and trend analysis tools. Track every dollar as it moves through your business, with real-time visibility into inflows, outflows, and net positions. Our intelligent system highlights spending patterns, revenue fluctuations, and potential cash shortfalls—so you can take action before challenges arise, not after.

With interactive visuals, historical context, and forward-looking projections, you’ll gain the clarity needed to plan ahead with confidence. Whether you’re managing day-to-day operations or preparing for future investments, Graph Nation equips you with the insights to budget wisely, scale strategically, and eliminate financial guesswork. No more surprises—just smarter, sharper decision-making.

Predictive Risk Management

Anticipate risk before it becomes reality. At Graph Nation, we harness the power of machine learning and advanced data analytics to identify early warning signs of financial instability, market volatility, and operational inefficiencies. Our predictive models continuously analyze patterns across your financial ecosystem, surfacing subtle anomalies and emerging threats that might otherwise go unnoticed.

With intelligent alerts and actionable recommendations, you can move from reactive to proactive—making strategic decisions that protect margins, preserve cash flow, and strengthen long-term resilience. Whether it’s navigating shifting market conditions or preventing internal bottlenecks, Graph Nation empowers you to lead with confidence, even in times of uncertainty.

Compliance Checks & Fraud Alerts

Regulatory compliance and fraud prevention shouldn’t be reactive—and with Graph Nation, they don’t have to be. Our platform runs automated checks in real-time, continuously scanning your financial data against industry regulations, compliance frameworks, and custom internal rules. From detecting unusual transactions to surfacing gaps before they become liabilities, Graphnation keeps your oversight sharp and your risk exposure low.

Intelligent alerts and audit-ready reporting reduce the burden on your finance and compliance teams, freeing up time while boosting accuracy. Whether you’re navigating evolving regulations or safeguarding against internal threats, Graph Nation gives you the visibility and control to stay one step ahead—no surprises, no compromises.

Transform Data into Decisions – Unlock Your Business Potential with Graph Nation.

Most Frequently Asked Questions

How does the real-time dashboard work?

Can Graph Nation help forecast cash flow trends?

What is predictive risk management, and how does Graph Nationuse it?

Predictive risk management uses AI and data analytics to flag financial risks before they become major problems. Graph Nation identifies patterns in your data and external indicators to forecast potential threats—such as liquidity issues, market shifts, or irregular expenses—so you can act early.

How does Graph Nation support compliance and fraud prevention?

Is my financial data secure with Graph Nation?

From Our Blogs

In today’s hyper-connected and fast-moving business world, decisions can’t wait—and neither can your data. As we move deeper into 2025, traditional Management Information System (MIS) reporting…

In the age of instant gratification and real-time everything, business leaders no longer have the luxury of waiting days—or even hours—for insights. As companies navigate increasingly complex…

The role of the Chief Financial Officer (CFO) is undergoing a dramatic transformation. No longer confined to balance sheets and quarterly reports, today’s CFO is expected to be a strategic partner…